Business Insurance in and around San Jose

One of San Jose’s top choices for small business insurance.

Insure your business, intentionally

Help Protect Your Business With State Farm.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Ana Orozco. Ana Orozco can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of San Jose’s top choices for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

Whether you are a podiatrist a psychologist, or you own a hobby shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Ana Orozco can help you discover coverage that's right for you and your business. Your business policy can cover things such as business property and loss of income and extra expense.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Ana Orozco's team today with any questions you may have.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

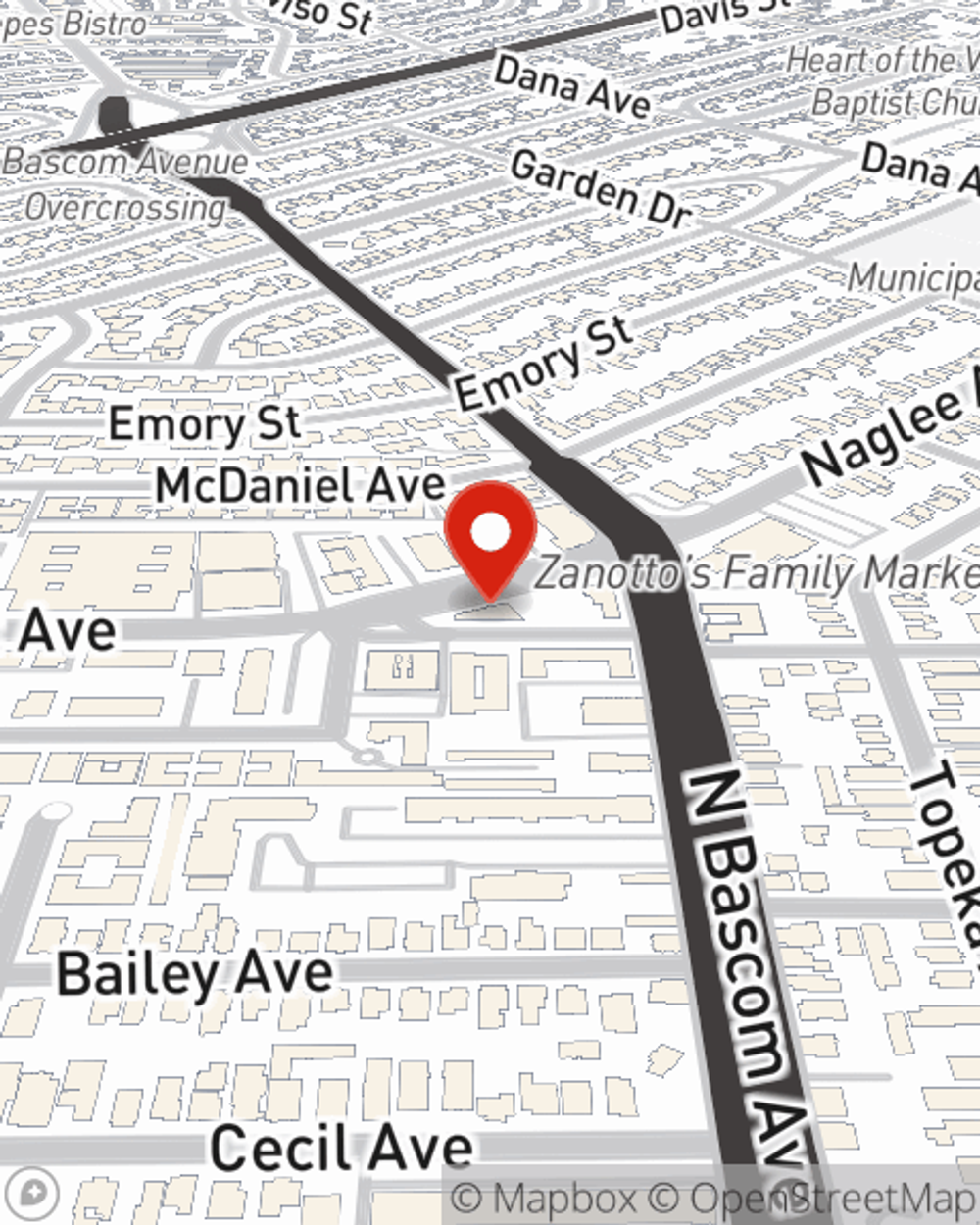

Ana Orozco

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.